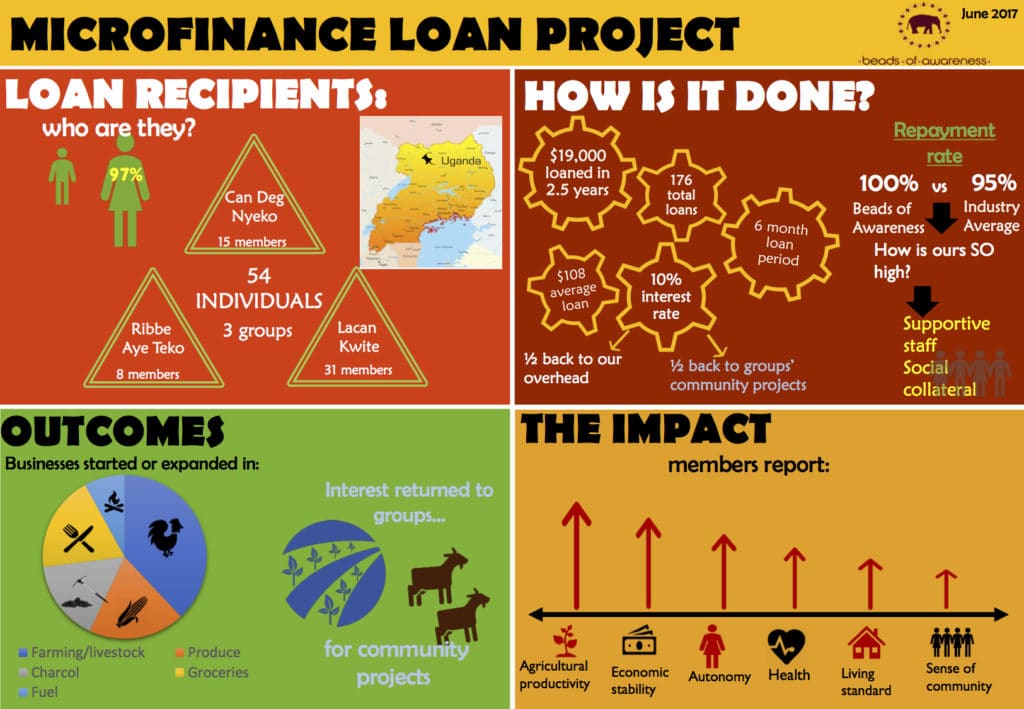

Microfinance Loan Project

Since 2014, we have offered loans to our artisans and other members of the community to encourage livelihood projects. We conducted an evaluation at the end of the 5th loan cycle (each cycle lasts 6 months) to see how we were doing.

Here’s a snapshot of the results:

Stories From The Field

Bead and Fabric Purchases

Since 2009 we have supported groups of artisans in and around Gulu through our purchases. Meet some of our artisans.

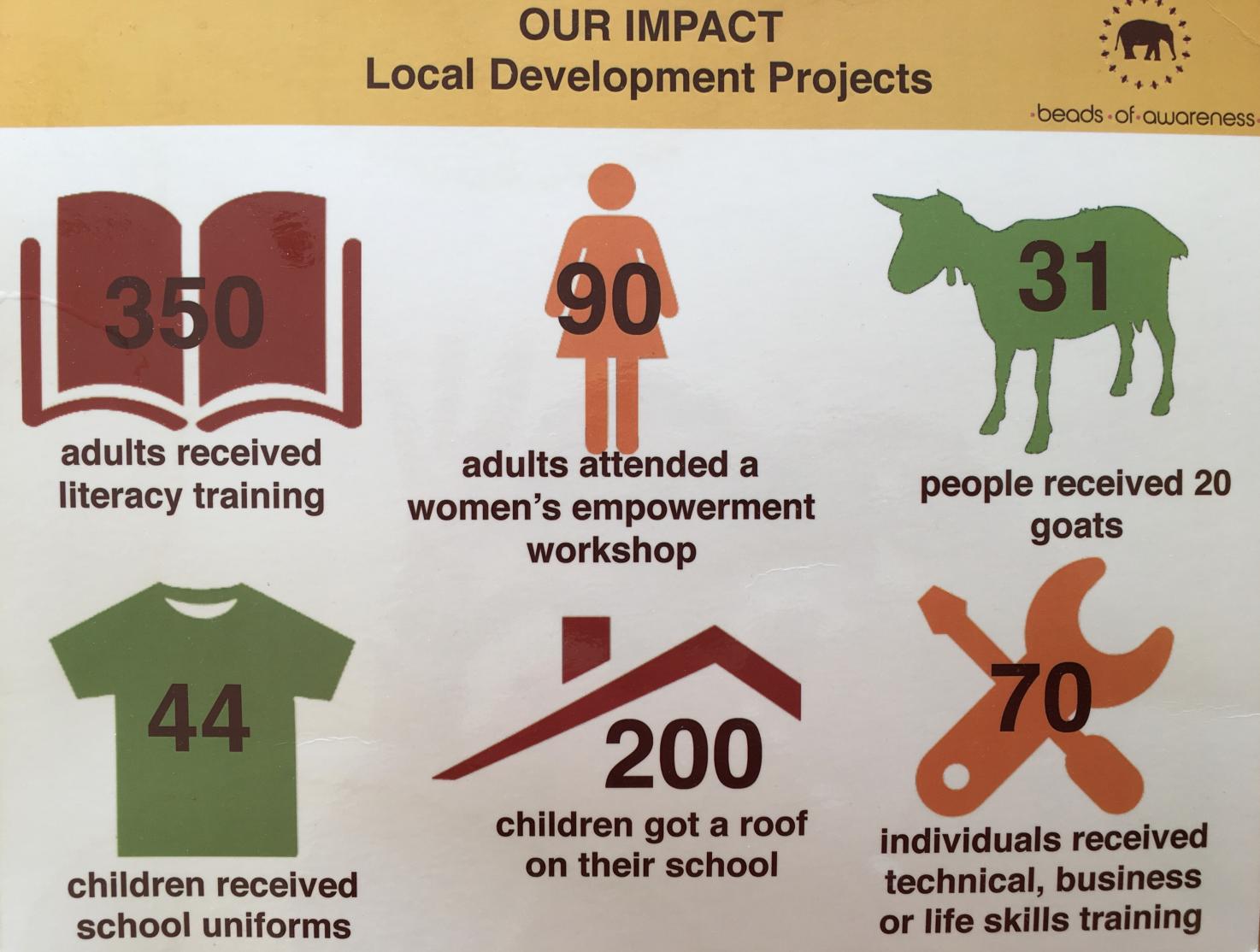

Development Projects

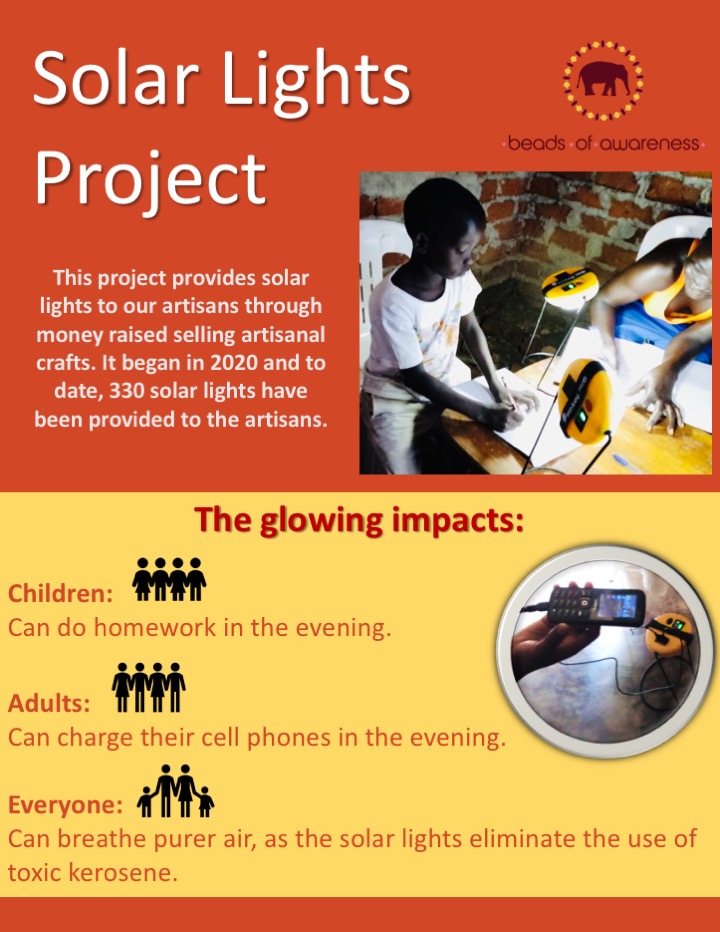

Find out more about the local development projects we’ve supported on our homepage, but here’s the impact at a glance. We have also bought 330 solar lamps for our artisans.